Call option simulator

An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Copies of this document may be obtained from your broker from any.

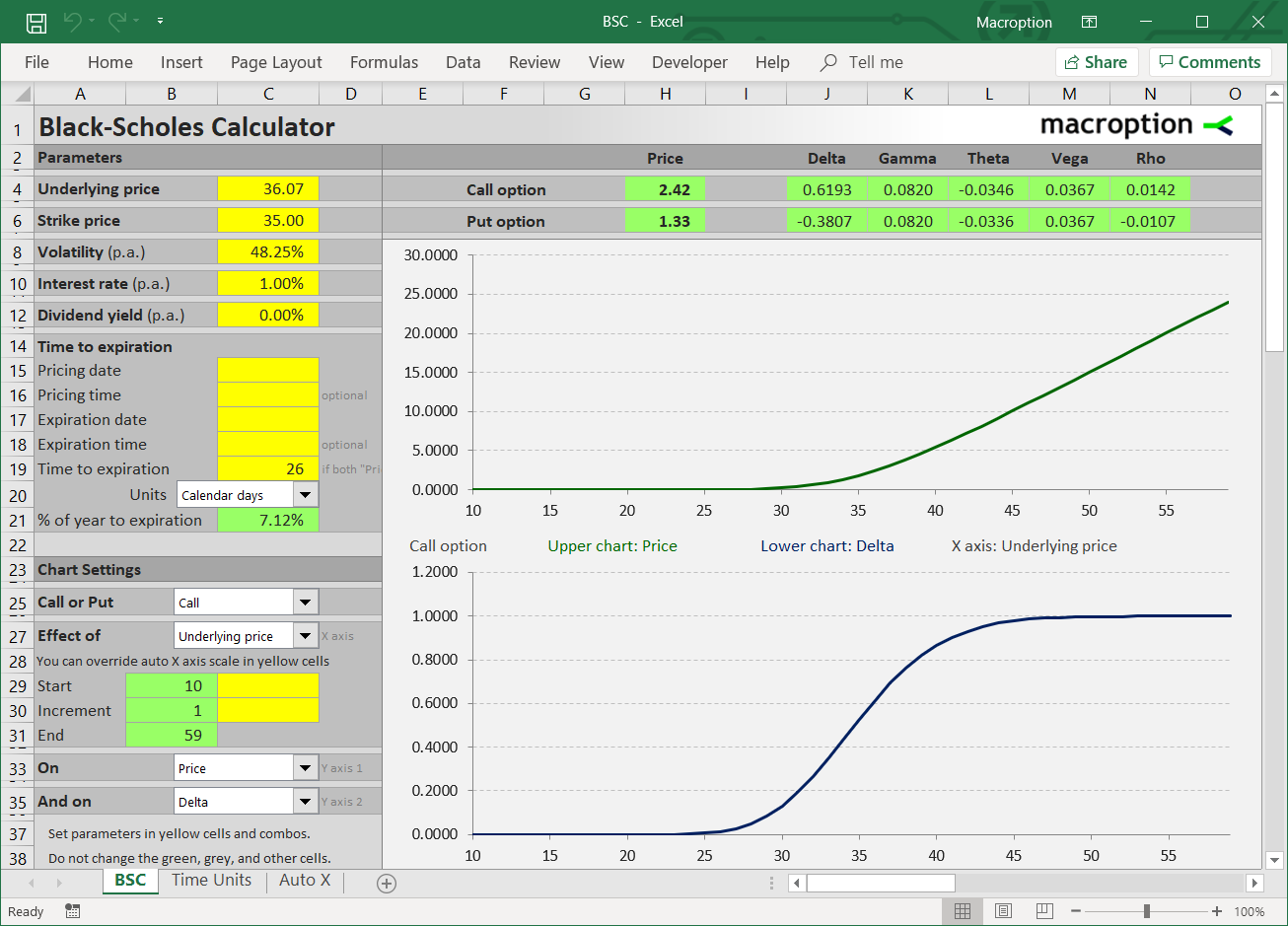

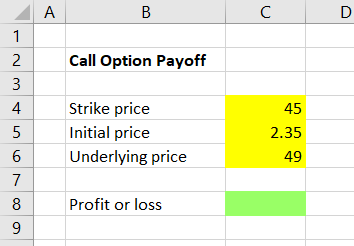

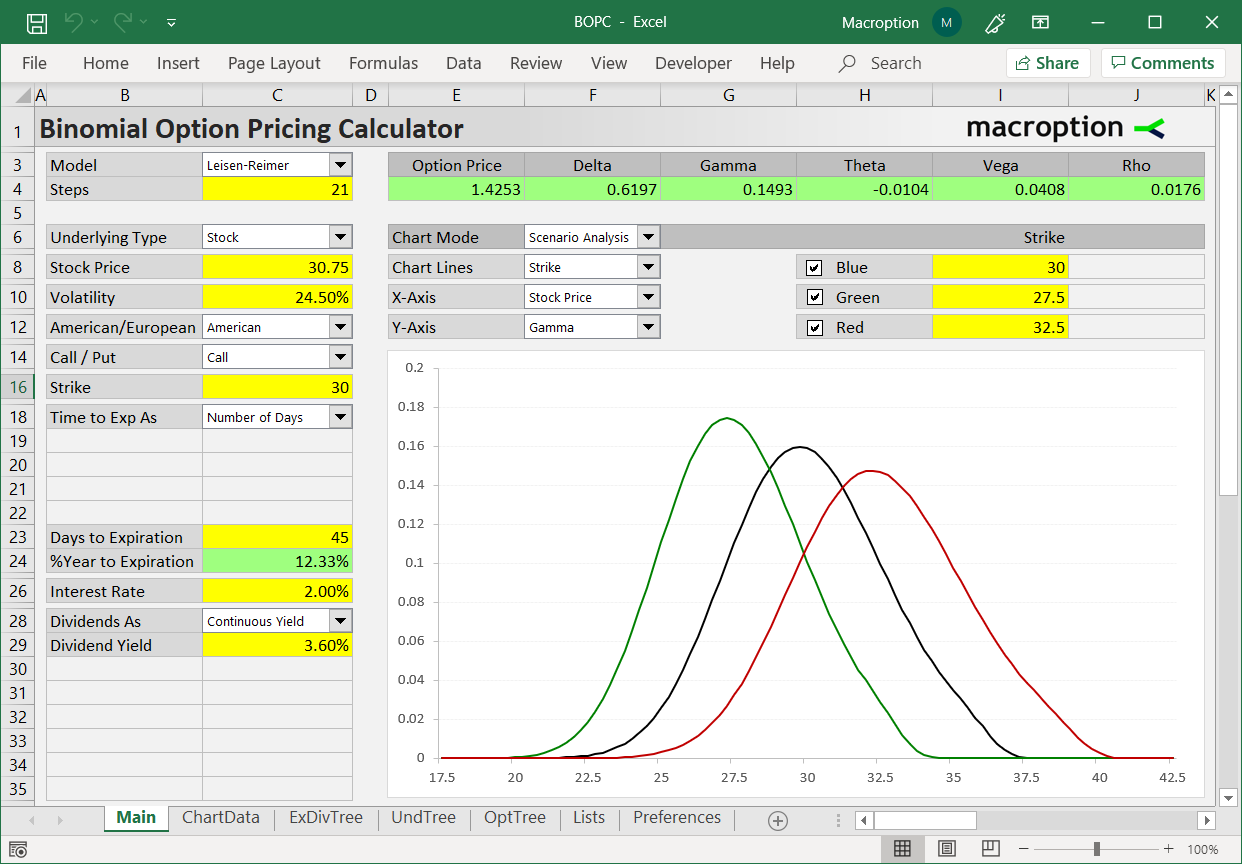

Calculating Call And Put Option Payoff In Excel Macroption

The gain or loss is calculated at expiration.

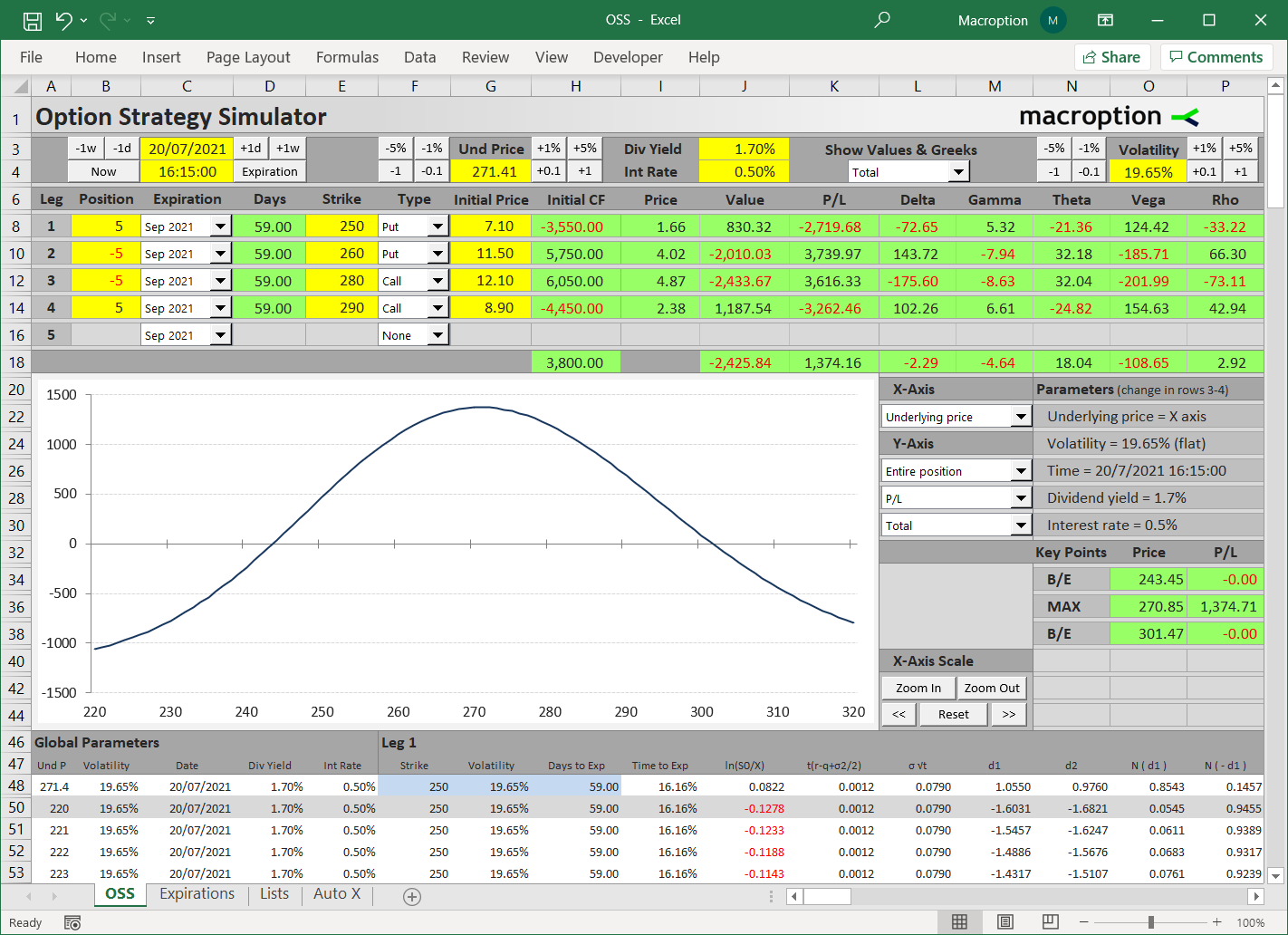

. You can choose to view the values PL and Greeks either per. Side QTY Type Expiration Strike Price Total. Simulation of covered call on stock portfolio 31 Parameters and basic assumptions For the simplest form of covered call portfolio one share of a certain stock and one short call option.

Select Products Exchange Ticker Next Only show the total PL graph. EOption Exercise your option to save with eOption and practice options trading with 100000 in. Required margin for this.

Of course this is not free. The option strategy builder allows you to construct different option and future products. Call Put.

The simulators spread input is for the entire position for the period so in the typical 90 cash 10 call setup a 5 option spread would amount to a spread of 5 for the entire position. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

There is an excellent software package for options traders called OptionVue. Call Option Contract Simulator Live on Gatsby Cloud. This app calculates the gain or loss from buying a call stock option.

Call Option Calculator is used to calculating the total profit or loss for your call options. To start select an options trading strategy. Your simulator will then mimic the actual circumstances of the.

Free options simulator to test your options strategyOnce the file is uploaded to optionscrack you can see the options chain and OI graph displaying the dataYou can create positions. Create Analyze options strategies view options strategy PL graph online and 100 free. Profile Type Output.

Use this web simulator to generate realistic option contract scenarios before entering the market with real money. The simulator instantly shows option prices dollar value profit or loss and Greeks for individual legs and for the entire position. When purchasing a call option you are buying the right to purchase.

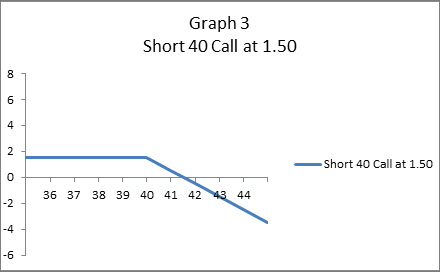

The long call calculator will show you whether or not your options are at the money in the money or out. Call options are financial contracts that give the option buyer the right but not the obligation to buy a stock bond commodity or other asset or instrument at a specified price. The Profit at expiry is the value less the premium initially paid for the option.

You can trade call and put options but at this time the Simulator does not support writing options. The Investopedia Simulator will help you gain confidence before risking your own money. Your virtual options simulator will provide you with a virtual wallet preloaded with a set amount of virtual currency.

Basic Long Call bullish.

Macroption Option Calculators And Tutorials

Options Spread Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

A Beginner S Guide To Call Buying

Calculating Call And Put Option Payoff In Excel Macroption

Options Strategy Builder Analyzer Online Optioncreator

Options Strategy Payoff Calculator Excel Sheet

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Call Option Profit Loss Diagrams Fidelity

Macroption Option Calculators And Tutorials

Call Option Calculator Put Option

Thinkorswim Papermoney Options Trading Simulator Tutorial Youtube

5 Best Options Trading Platforms For 2022 Stockbrokers Com

Options Spread Calculator

Macroption Option Calculators And Tutorials